HOW TO SEARCH AND PAY TAXES ONLINE

Click on the links below for instructional information

I. How to Search for an Account

II. Quarterly Installments and Payment Schedule

III. How to Pay (Shopping Cart)

IV. Printing Online Bills and Receipts

How to Search for an Account

back to topTo pay taxes online, you must first locate the account(s) by following these steps:

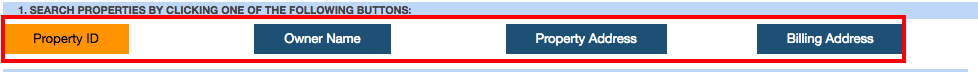

Step 1: Select the appropriate button for your search; either by Property ID, Owner Name, Property Address or Billing Address.

See Illustration 1. Once you select an option, instructions will appear with examples of how to enter the applicable criteria.

Step 2: Enter the appropriate criteria:

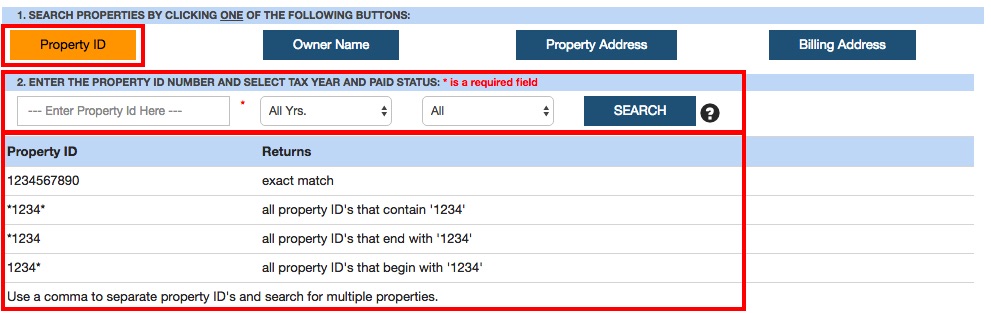

a) If you selected Property ID in Step 1, enter the property ID in the field provided using only numbers and click the

"Search" button. If you have any questions about how to enter the property ID or what results will be retrieved,

instructions with examples of how to enter the property ID appear below the search field. See Illustration 2.

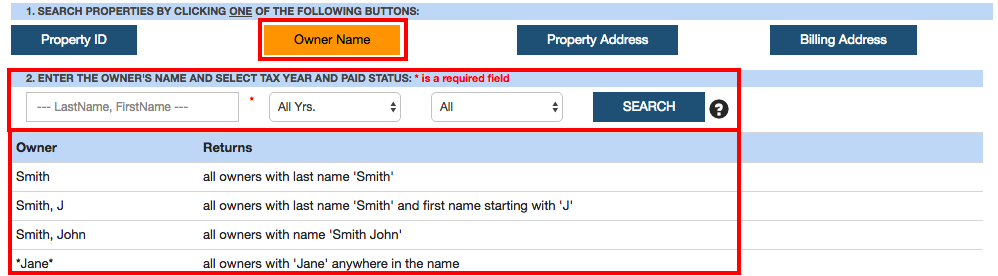

b) If you selected Owner Name in Step 1, enter the owner name in the field provided. If you are entering a last name

and first initial or first name, you must put a comma between the last name and first name/initial. Then click the

"Search" button. If you have any questions about how to enter the owner name or what results will be retrieved,

instructions with examples of how to enter the owner name appear below the search field. See Illustration 3.

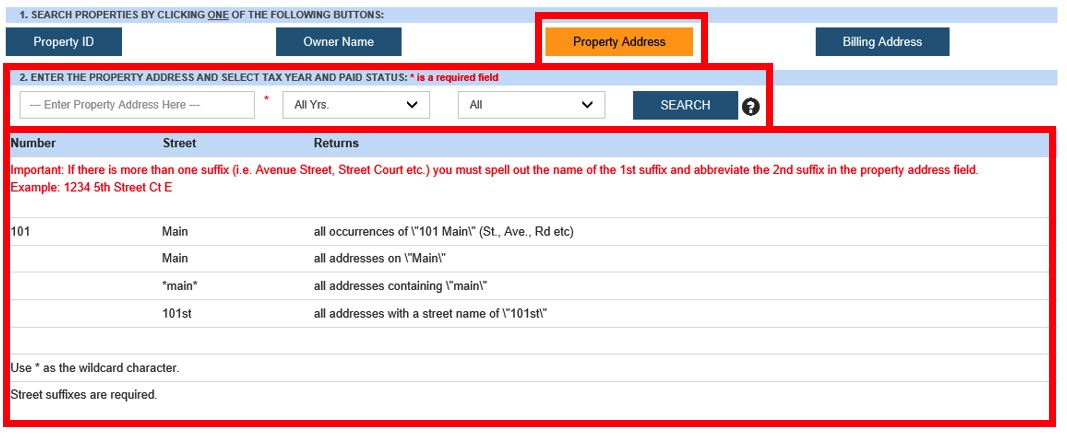

c) If you selected Property Address in Step 1, enter the property address

in the field provided and click the "Search" button. If you have any questions about how to enter the property address or what results will be retrieved, instructions

with examples of how to enter the property address appear below the search field. See Illustration 4.

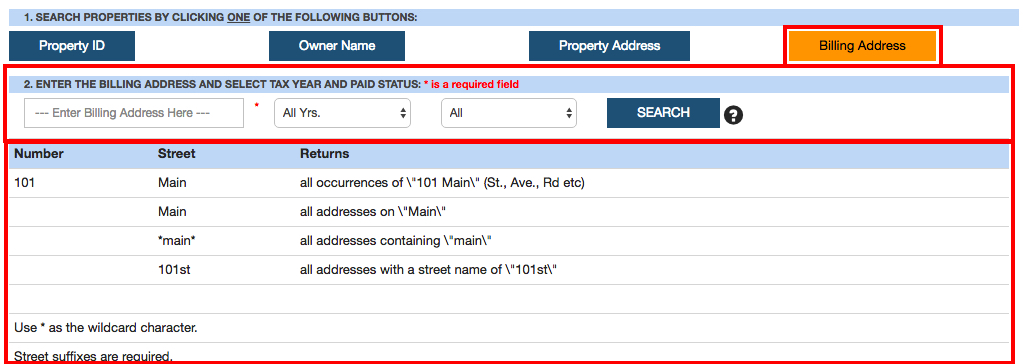

d) If you selected Billing Address in Step 1, enter the billing address in the field provided (this is the address where

you receive your mail) without the city and state. Then click the "Search" button. If you have any questions about

how to enter the billing address or what results will be retrieved, instructions with examples of how to enter the

billing address appear below the search field. See Illustration 5.

Note: You can narrow your search results by selecting a specific Tax Year and/or Status (i.e. paid or unpaid) from

the appropriate drop down boxes in the search fields.

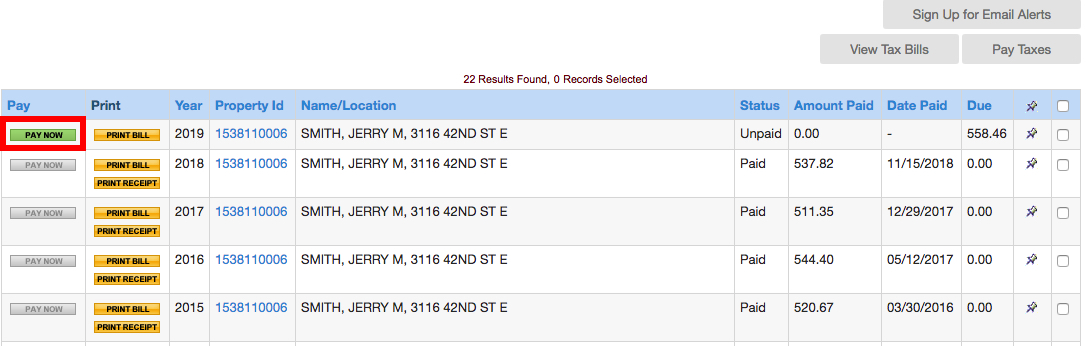

Step 3: From the Property Search Results page, find the property in the list that you wish to pay. Click the  button

located in the far left column in the row for that property. See Illustration 6.

button

located in the far left column in the row for that property. See Illustration 6.

PAY NOW

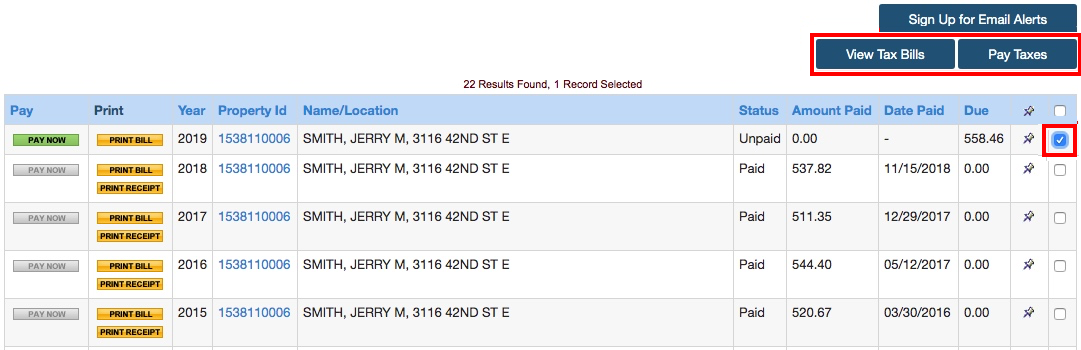

Step 4: In order to select multiple properties for payment, a checkbox to the right of each account is available to select. This

checkbox is used to add one or more properties to the cart and to obtain a copy of each account's tax bill. See

Illustration 7.

Note: Both the "View Tax Bills" and "Pay Taxes" button are disabled until you begin selecting properties by clicking the

checkboxes. Additionally, if you select an account that is already paid, the "Pay Taxes" button will be disabled. The button is enabled only if all selected properties are eligible for payment.

See Illustratiion 7.

How to Search for an Account

>

>

>

>

>

>

Quarterly Installments and Payment Schedule

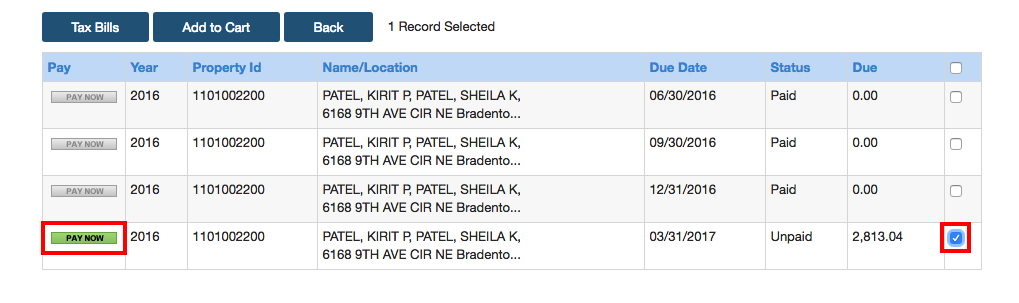

If you are making a payment on an installment account, clicking the Image  PAY NOW

will first bring up the list of quarterly scheduled payments. Select the appropriate quarter(s) by marking the checkboxes for each quarterly scheduled payment

that are due and then click the "Pay Now" button. See Illustration 8 below.

PAY NOW

will first bring up the list of quarterly scheduled payments. Select the appropriate quarter(s) by marking the checkboxes for each quarterly scheduled payment

that are due and then click the "Pay Now" button. See Illustration 8 below.

Illustration 8.

Please review the Payment Schedule for Installments if you receive one of the following validation errors:

- Invalid Payment for Account Number: <123456789>. Quarter 1 can only be paid in June (with a discount) and July (without a discount) and Quarter 2 can only be paid in September. Quarter 3 & 4 are not available for payment until November. For help with installment payments, click on the 'Help' menu item and select 'How to Search & Pay Taxes Online'.

- Invalid Payment for Account Number: <123456789>. All unpaid quarters must be selected and paid.

| Payment Schedule for Installments | |

| Month | Payments Allowed |

| June | 1st quarter only (with discount) |

| July | 1st quarter only (no discount) |

| August | No payments allowed |

| September | Quarter 2 only |

| October | No payments allowed unless tax roll is opened in October for early collection (prior to Nov. 1st). If tax roll is opened for collection in October, then the details under "November" below apply in October only from the time that the roll is opened for collection. |

| November | May pay Quarters 3 and 4 early |

| - If 2nd quarter unpaid, may choose the above option but must also pay Quarter 2 | |

| - Cannot pay only Quarter 2 at this time | |

| - Cannot pay only Quarter 3 at this time | |

| December | Quarter 3 |

| - May pay Quarters 3 and 4 | |

| - If Quarter 2 unpaid, may choose from the above two options but must also pay Quarter 2 | |

| - Cannot pay only Quarter 2 at this time | |

| January | May pay Quarter 4 early |

| If Quarter 2 and/or Quarter 3 unpaid, may choose the above option but must also pay Quarters 2 and 3 | |

| Cannot pay only Quarters 2 and/or 3 at this time | |

| February | May pay Quarter 4 early |

| If Quarter 2 and/or Quarter 3 unpaid, may choose the above option but must also pay Quarters 2 and 3 | |

| Cannot pay only Quarters 2 and/or 3 at this time | |

| March | Quarter 4 |

| - If Quarter 2 and/or Quarter 3 unpaid, must pay them at this time | |

| - Cannot pay only Quarters 2 and/or 3 at this time | |

| April | Must pay all unpaid Quarters |

| May | Must pay all unpaid Quarters |

How to Pay (Shopping Cart)

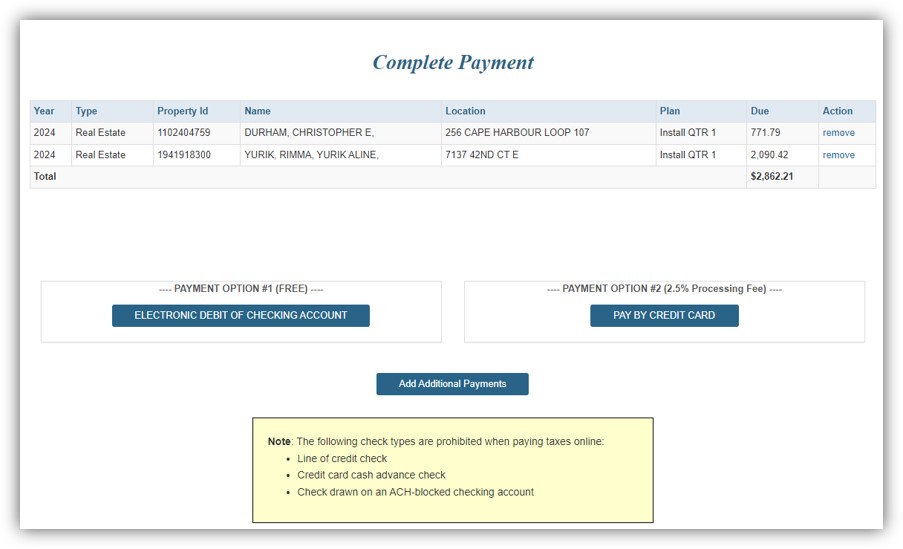

After selecting a property or multiple properties for payment by selecting the 'Pay Taxes' button, a page will load that allows you to

choose your online payment type. You must select Payment Option #1 (Electronic Debit of Checking Account) or Payment Option #2

(Pay by Credit Card). See Illustration 9.

You will be able to view the grand total before you checkout.

Payment OptionsYou will be able to view the grand total before you checkout.

1. Payment Option #1 (Pay by Electronic Debit of Checking Account): Once you select 'Electronic Debit of Checking Account',

you must select 'Continue' and you will be directed to the CHECKOUT page.

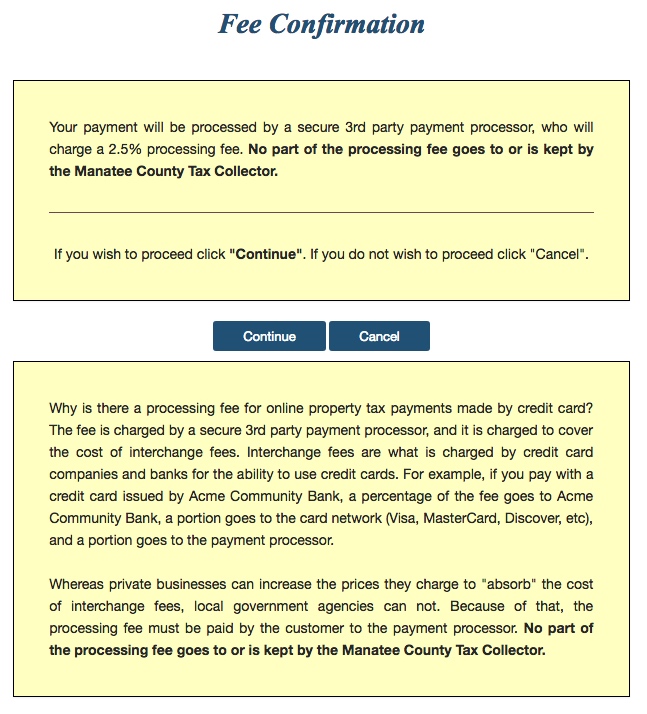

2. Payment Option #2 (Pay by Debit or Credit Card): Once you select 'Pay by Credit Card', you must select 'Continue' which indicates that you understand a convenience fee will be assessed and you wish to proceed. See Illustration 10. Once you select 'Continue', you will be directed to the CHECKOUT page which displays the convenience fee in red prior to entering your payment information.

2. Payment Option #2 (Pay by Debit or Credit Card): Once you select 'Pay by Credit Card', you must select 'Continue' which indicates that you understand a convenience fee will be assessed and you wish to proceed. See Illustration 10. Once you select 'Continue', you will be directed to the CHECKOUT page which displays the convenience fee in red prior to entering your payment information.

Illustration 9.

Illustration 10. (Payment Option #2).

Once you select 'Complete Transaction', a new browser window will open directing you to Payment

Express, the Manatee County Tax Collector's Property Tax Payment site, where you will be able to

continue making your online payment.�You will be taken through the payment process and once you

complete your payment, a confirmation page will be displayed. This page can be printed for your

records�and�you will also receive a confirmation email at the email address you provided during the

payment process.

NOTE: In order to avoid duplicate payments, please do not click twice when submitting your payment and do not click the back button.

back to top

NOTE: In order to avoid duplicate payments, please do not click twice when submitting your payment and do not click the back button.

back to top

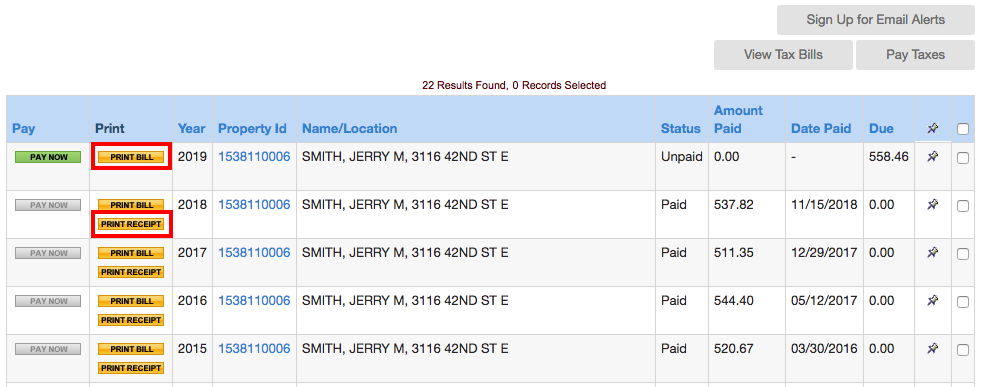

Printing Online Bills and Receipts

Provided all account information was entered correctly and your payment clears, you will have the option to print a duplicate receipt

within three (3) business days on taxcollector.com from the Tax History Results or the Detail page. You also have the option of

printing a duplicate bill.

To print a paid receipt, you must first locate the account(s) by following the instructions in Step 1 and Step 2 at the top of this document, and then select the yellow 'Print Receipt' button. The button will only retrieve the duplicate tax bill for that particular tax year, not a paid receipt. See Illustration 12 below.

To print a paid receipt, you must first locate the account(s) by following the instructions in Step 1 and Step 2 at the top of this document, and then select the yellow 'Print Receipt' button. The button will only retrieve the duplicate tax bill for that particular tax year, not a paid receipt. See Illustration 12 below.

Illustration 12.

Please be sure to read all disclaimers. The accuracy of the information provided on this website is not guaranteed for legal

purposes, and we are not responsible for payment transactions that could not be processed as the result of technical difficulties

such as downtime due to system maintenance or any other occurrence.

back to top